Advisory firm RLA Global has released its 2025 Wellness Real Estate Mid-Year Report, which evaluates how wellness affects average hotel performance across 11,000 properties worldwide.

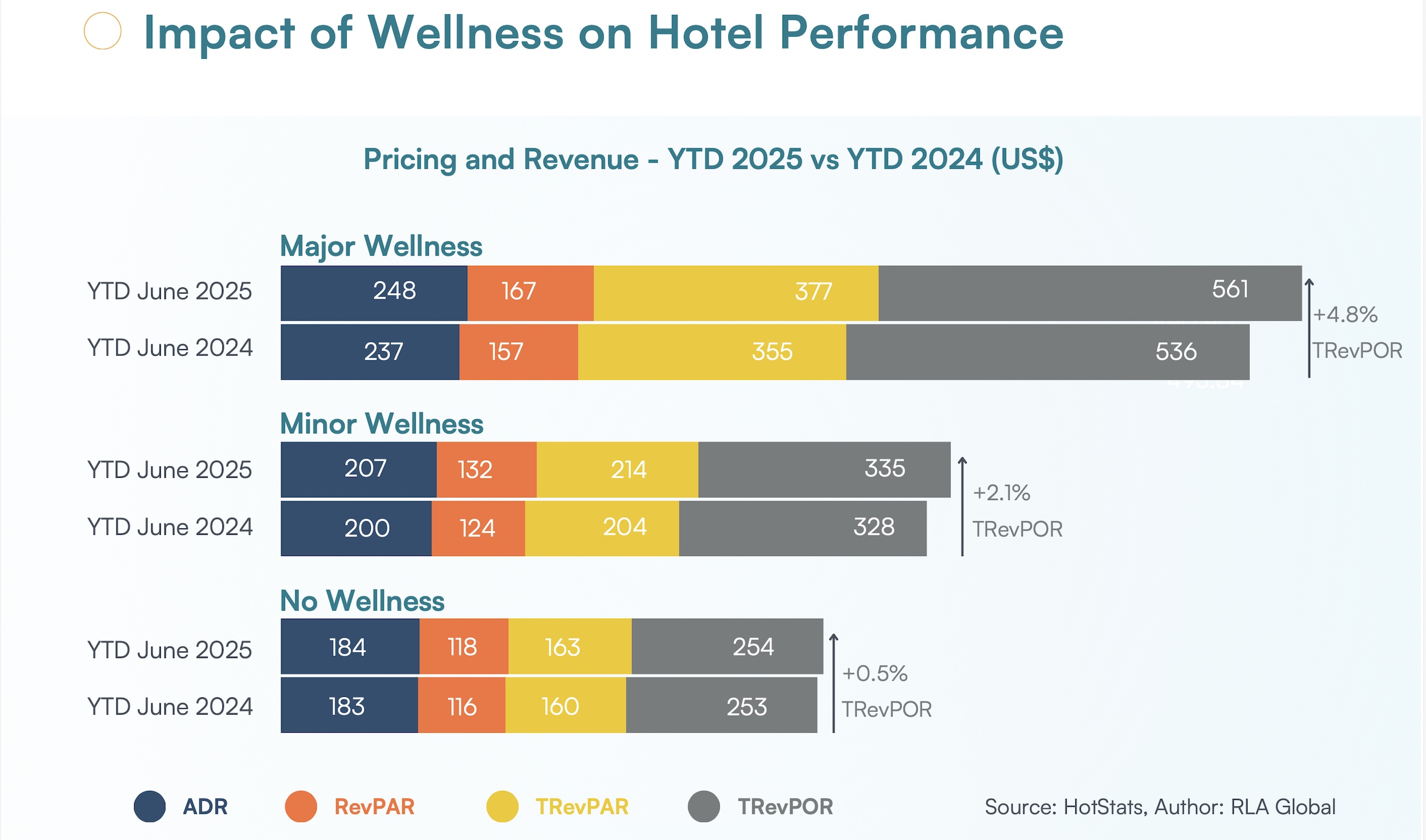

The headline finding from the 2025 report is that the wellness hospitality sector is demonstrating remarkable stability amid persistent economic pressures.

“As inflationary forces erode discretionary income and soften demand at lower price points, properties with robust wellness offerings remain stable, proving their strategic value by driving ancillary spend,” said Roger Allen, CEO at RLA Global.

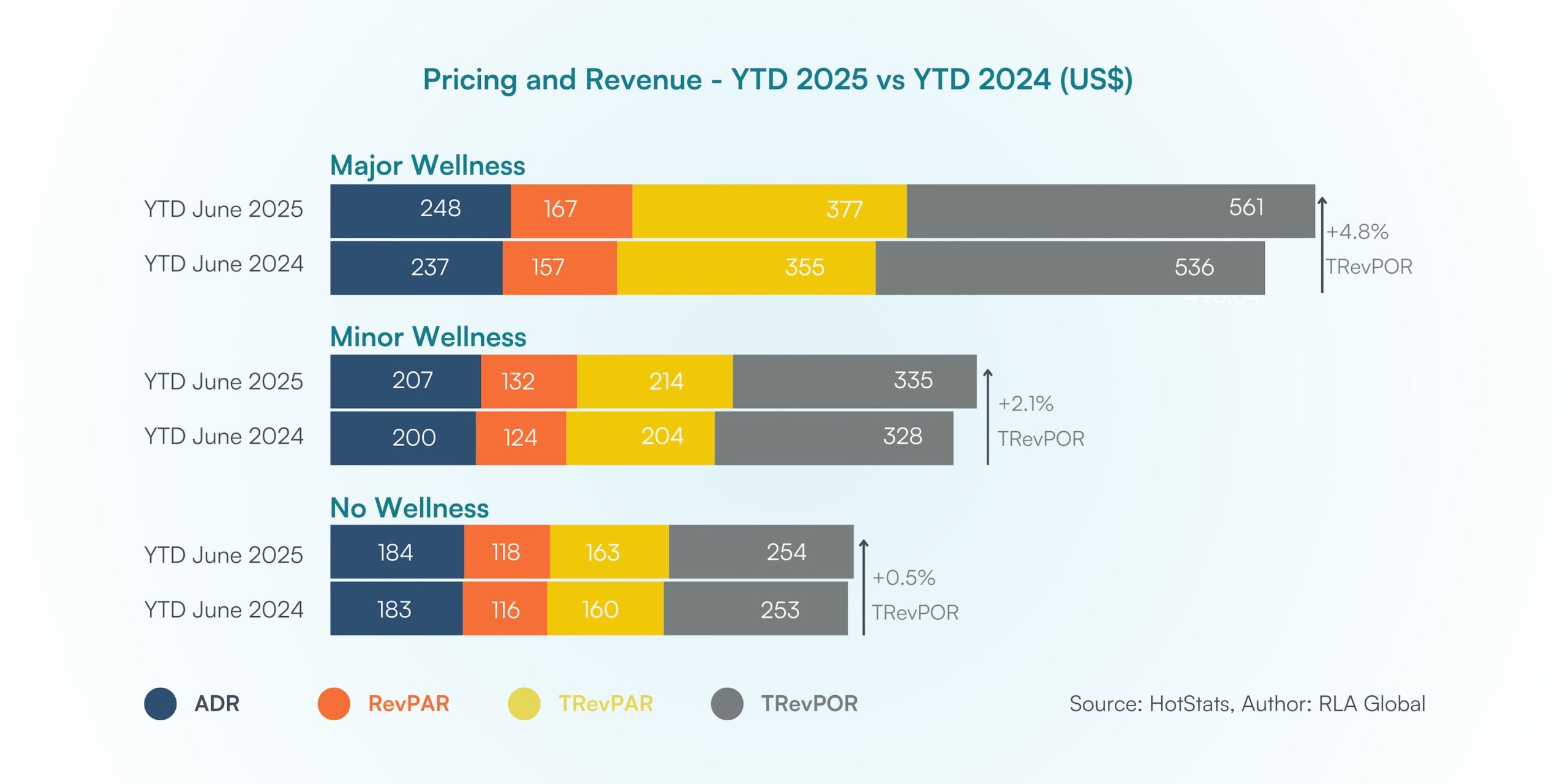

Revenue across all wellness categories remains strong, with Total Revenue Per Available Room (TRevPAR) and Average Daily Rate (ADR) holding firm through the first half of 2025.