Advisory firm RLA Global has released its 2024 Wellness Real Estate Mid-Year Report, offering critical data and analysis, plus actionable insights for real estate investors and developers.

The report compares property-level data from January to June 2024 with the same period in 2023.

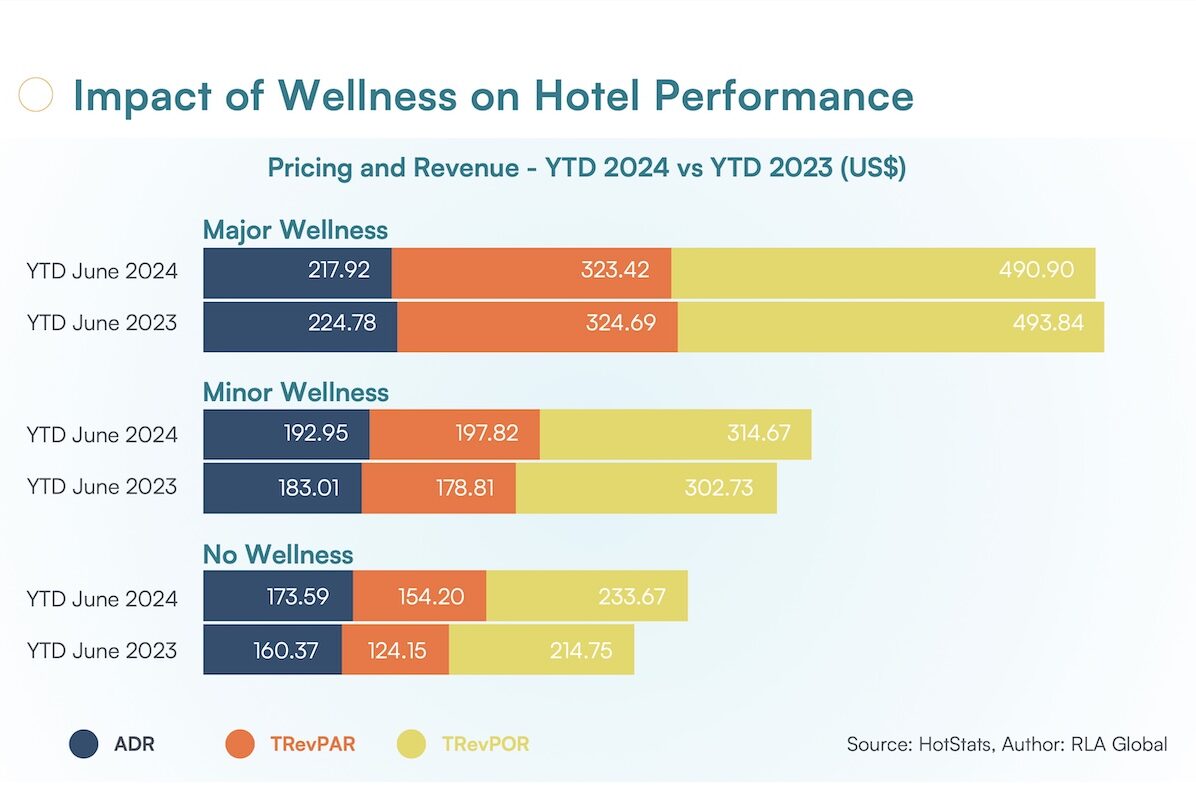

The mid-year update evaluates average hotel performance based on HotStats data, covering major, minor and no-wellness hotels of different classes worldwide.

RLA Global compares year-to-date figures with the same period in 2023 to help operators understand how hotels with different wellness offerings perform across all segments of hospitality.

Headline findings show mixed results for wellness hotels, with minor wellness leading growth.