The fourth annual Future of Wellness report, by McKinsey & Company, reveals Millennials and Gen Z-ers are redefining the wellness landscape.

Younger consumers are reshaping how and where wellness is experienced, leading a revolution grounded in daily, deeply personalised habits, redefining wellness as an ongoing practice rather than a reactive solution.

Despite making up just a third of the US adult population (36 per cent) Gen Z are driving 41 per cent of annual wellness spend; Millennials aren’t far behind. The report suggests this is due to younger generations prioritising wellness because of (self-reported) higher levels of burnout and worsening health.

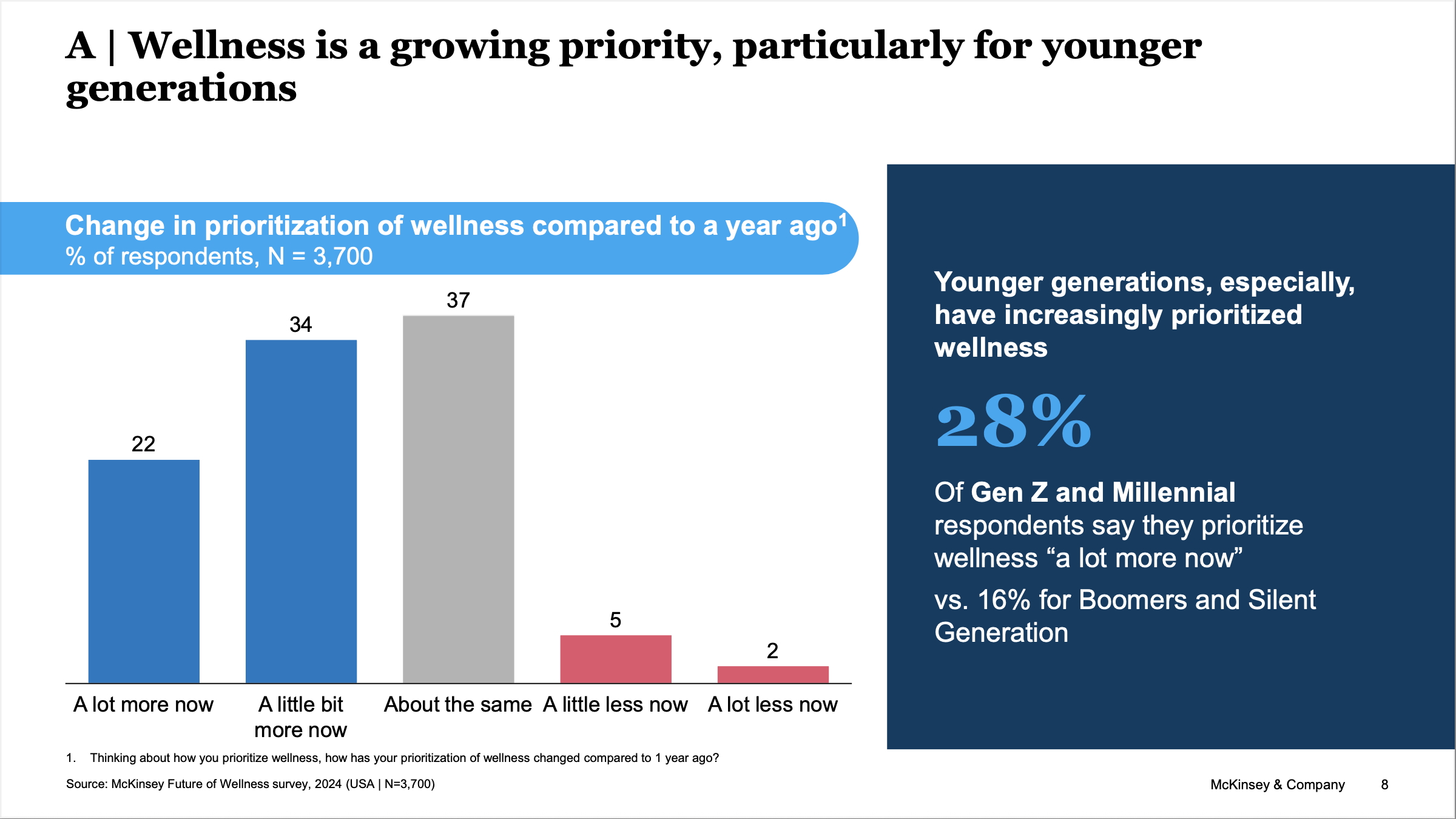

Nearly 30 per cent of younger consumers have intensified their wellness spending in the past year. Their top priorities are sleep and health, followed closely by appearance.